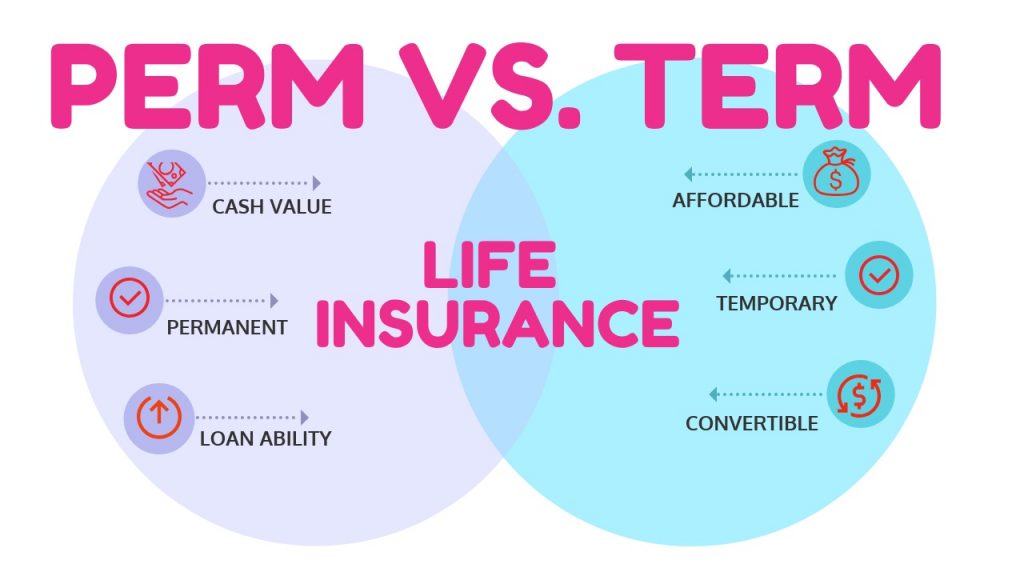

Term Life Vs Permanent Life Insurance

Term Life Vs Permanent Life Insurance – Choosing between life insurance types can often be a tedious and long process. There are many options available for the policies, as well as terms within those options. Companies offer so many types because everyone seems to need something unique to their situation, lifestyle, etc. Two of the most common types are term life insurance and universal life insurance. Slot Game Online.

Term Life Insurance Explained

This is a policy set up to cover a person for a specific amount of time. Premiums and coverage never change, and after the term is up, there may be an option for renewal. For instance, a family with a mortgage might be best off to have both spouses covered. Another case for using term life insurance is when there are still children at home. Often times this kind of policy will remain in effect until the last child leaves home at age 21. Slot Game Online.

One last example where people often use this type of policy is with a stay at home parent. A death benefit can keep the rest of the family financially afloat in regards to daycare for younger children, and other spousal duties. It’s very important to consider what would happen to a family if a stay at home spouse were to pass away. Often times they are over looked because they have no income. The money they are saving the family though, in cleaning and daycare bills, adds up and should be considered for their own term life insurance policies. Slot Game Online.

Permanent Policies Explained

Permanent policies are characterized by their cash values and death benefits. One of these common policies is universal life insurance. This kind of policy is used for people who want to have a more hands on approach with their coverage and cash value. The popular idea behind universal life insurance is that the premiums, pay out, and cash value are all decided by the owner. If their wishes change, the universal life insurance policy is easy to alter by additional deposits. Slot Game Online.

Have More Control Of The Investment

There are many reasons to choose the universal life insurance policy over other kinds of policies. Of course, by having this control the owner must also keep an eye on the balance to be sure. There is enough money for the death benefit they desire. The transparency of the universal life insurance policy is a nice addition as well. In universal policies, they will have access to each itemized fee taken comparable to a bank statement. Slot Game Online.

Choosing the proper death benefit for your needs requires a lot of consideration. There are many options as far as the kind of coverage you want, and whether you want to be able to benefit from the investment while you are still alive. Taking the time to research your needs before you discuss them with an underwriter will assist you in being that much more prepared for this large purchase. Slot Game Online.

Choosing What Is Best For You

While it seems like there are a lot of options. This is only to express how individual each person’s own needs are. The Internet provides a way for you to gather all of the information you need prior to speaking to an advisor, but they are usually available for questions, so don’t hesitate to call one. In the mean time, take your time in considering what option best suits your needs and when you are ready, start looking into life insurance quotes. Slot Game Online.

Read More About Finance Solutions, Insurance News, Finance News.