Car loans

Car loans – An auto loan or a car loan is a loan availed to buy a specific vehicle, which can be used or new. If you plan to finance your car through car finance programs or auto finance programs, there are many choices available as far as credit facilities are concerned, however the final availability of your car loan will depend upon on two main aspects – your income, and your car credit score. In case your credit score is not good enough, chances are you will end up paying a higher rate of interest for your car financing facility.

Knowing your credit score can help you decide the manner of availing your credit. In case of bad credit ratings, it is possible to improve your credit ratings and subsequently apply for the loan. If you credit score is below the national FICO average of 680 points, it is recommended you do something to improve upon your score before applying. The second criteria of your monthly income can also decide the result of availing your car credit facility. Even if you have a bad credit score, if you have a decent monthly income, you can still improve your chances of getting your credit.

Eligibility for car loans

Theoretically, almost anyone is eligible and can apply for car loans. As long as they have a certain plan to repay the loan, and have social security proving their citizenship. Other factors decide the extent to which you might be successful in actually availing the required car finance credit, however these factors can be either negotiated or improved upon. The borrower’s credit ratings or repayments history is important, but not a major factor when it comes to car financing. In short, it is possible to avail your car loan provided you have done your homework well, and have prepared well in advance for the credit facility. It is important to find the right kind of lender, who might offer you exactly what you need, and help you decide the manner in which you desire to avail your loan. Many such lenders are available.

Ways to avail car loans

The following options are generally used by individuals when they desire to obtain credit facilities to buy their car – new cars as well as used cars. Slot Game Online.

Banks and credit unions option –

Individuals usually prefer going to banks and credit unions to avail their car loans or auto loans. Bank auto loan programs are very popular since borrowers can avail attractive deals through these institutions. Credit unions offer lower interest rates as compared to most banks. Slot Game Online.

Home equity options –

Utilizing your home equity loan is another way of financing for your car. However, one needs to make sure that the security offered, usually your home, is not put to undue risk, since it may further encumber your most important asset value.

Online lenders option –

If you are bold enough, or you have the required expertise related to online companies. It is possible to conduct your financial transactions over the Internet, and avail your auto financing from online lenders. This option can be convenient for a variety of reasons online lenders usually compete aggressively for business and offer very competitive rates and contract terms. So the borrower tends to gain something extra from the finance deal. The biggest advantage is you do not have to leave the comfort of your home. Still carry out your transactions to buy your dream car. Slot Game Online.

Relatives option –

Even after trying all possible ways and means of availing auto finance. If everything fails, you can still use time-honored method of borrowing from your relatives. This option usually works, but it is important to know that it can put a strain on your relationship. So it is advisable to use this option as your last option, when nothing else seems to work out. Slot Game Online.

After availing your car loan

Majority of the lenders provide car loans without any major hassles. The borrower can enjoy their vehicles while paying their loan. Lenders or creditor do not pursue or harass their debtors unless there is some reason to do so. That reason is defaults in monthly dues and delinquency issues. So if you make your monthly payments regularly. Your lender will not take any steps to repossess your vehicle. In case you suffer or end up with any repayment issues. It is advisable you contact your lender, explain your problems to him or her. Find a way out to redeem through some acceptable compromise. Slot Game Online.

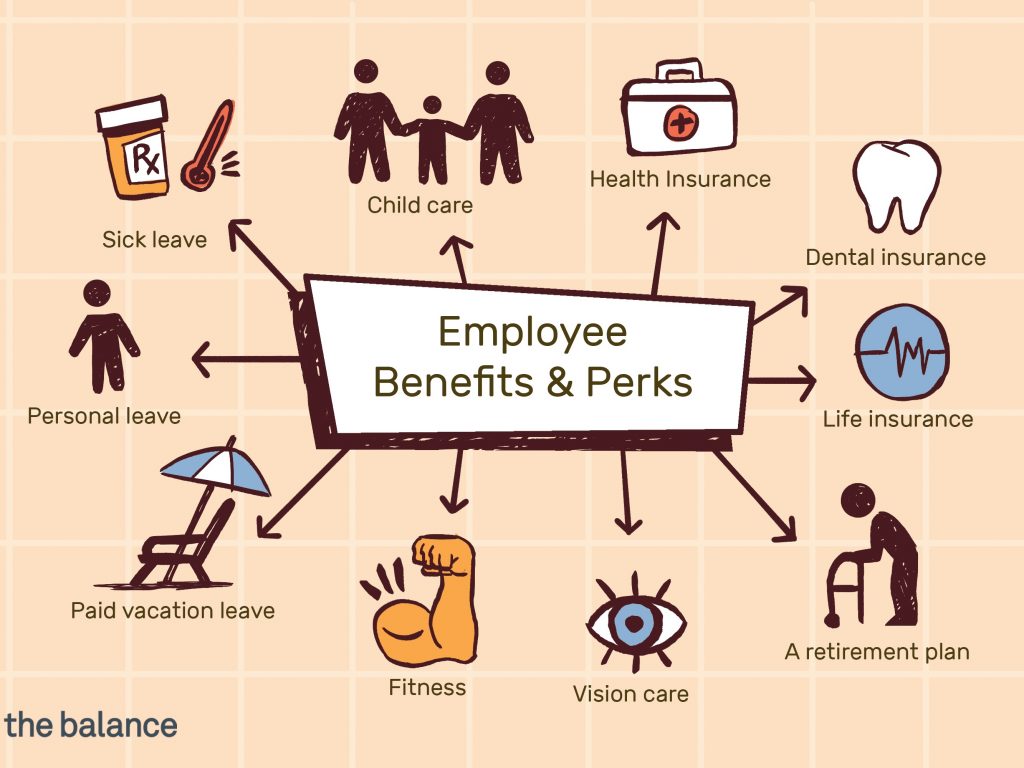

Maximize Your Employer Benefits

Maximize Your Employer Benefits