Maximize Your Employer Benefits

Maximize Your Employer Benefits

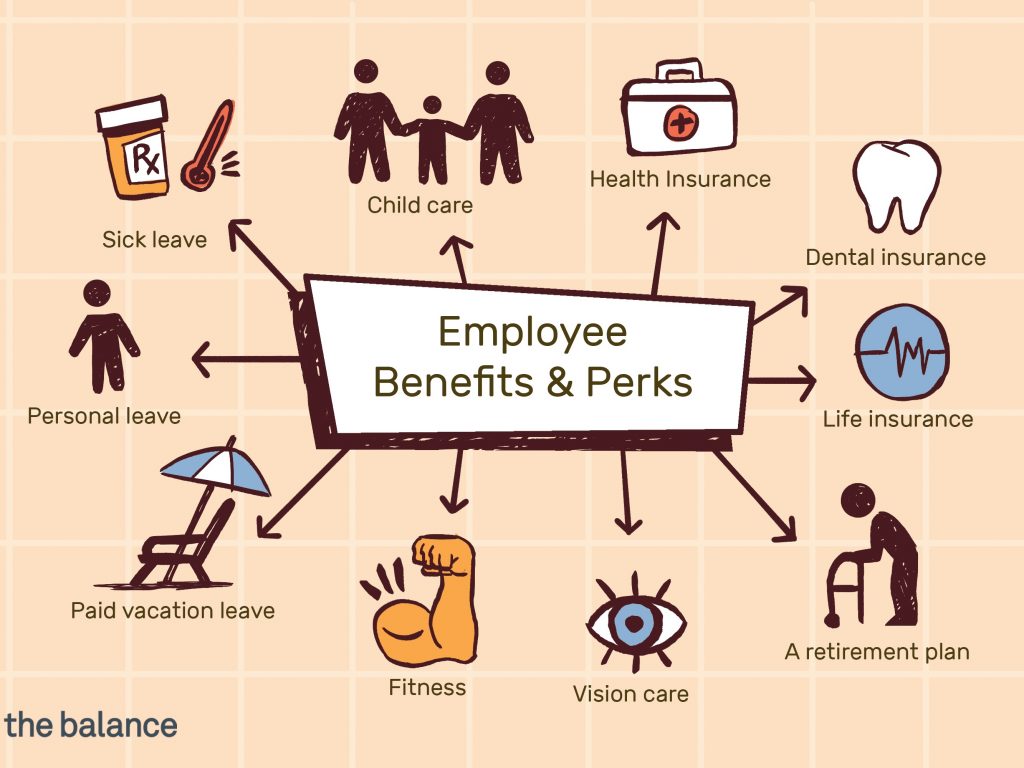

Maximize Your Employer Benefits – When it comes to Health Insurance and Benefits, how do you decipher through all the news and figure out what it is you need to focus on? For most people their employer benefits are linked to a myriad of things including; number of children, premium cost, takes home cash, health status, age, etc.

However it’s very important to always pay attention when it comes to the details. In 2013 the cost of health care is expected to rise about 7.5% In most cases this is faster than the rate our household income will increase in 2013. This 7.5% will mostly likely translate into higher premiums, deductibles, and co-pays. Here are a couple of budget saving tips that can be employed during open enrollment for 2013 to help bring a little bit more cash home, and add to your retirement.

Considering a Higher Plan Deductible

If you are a young healthy couple or individual in good health and have a healthy savings account, you can effectively lower the cost of your monthly insurance premium by choosing a HDHP (Higher Deductible Health Insurance Plan) The HDHP allows you to deducts funds from your paycheck pre-tax each month and contribute that amount to an HSA (Health Savings Account) This plan will allow you to reduce your overall taxable income annually (for families in the 25% tax bracket that’s a maximum out of pocket charge of $12,500 and 6,250 for individuals).

Pay Medical/Child Care bills with Tax Free Dollars

If you’re employer provides you the option to establish an FSA (Flexible Spending Account) account, always take it. The money that goes into an FSA account is pre-taxed and can be used for a lot of different medical expenses ( Co-Pays, prescription drugs, and other cost not covered by your insurance companies). Most company’s allow you to use your FSA to pay for qualifying child care expenses as well.

In 2013 you can contribute up to $2500 to an FSA for those in the 25% federal tax bracket, that’s $625 dollars. If you have children then you can contribute up to $5000 pre-taxed. This is a great opportunity to pay things that you would normally pay. Except you are not paying taxes on those dollars, saving you $600-$1500 or more annually. Note an FSA has to be used by March of the following year or it is lost. Maximize Your Employer Benefits.

Take Advantage of your Company 401K

The best things about 401k’s are the tax advantages. In 2013 you can deposit up $16,500 dollars pre tax to your 401k Account. This allows you to reduce your taxable income, while providing you a nest egg for your future. You can either give Uncle Sam your money, or you can save it away for your future.

Many employers will match a certain percentage of the employee’s contribution. Some companies will match a 100% of the employee’s contribution up to a certain point. This is FREE MONEY if you cannot contribute a large amount to your 401k, contribute enough to get the maximum match the company provides. Long after you leave your employer those dollars will still be accruing interest towards your retirement. Here are a couple of other things to think about when it comes to 401ks.

Investment customization and flexibility

Loan and hardship withdrawals

Maybe your healthy, or just don’t have the means. With the increase cost of insurance it may seem much easier to avoid dealing with the whole situation. Forego health insurance completely. There are a couple of things to think about if you are in that mind frame; starting in 2014 having health insurance will be mandatory for every individual, but it would be very foolish to wait till 2014. A simple doctor or hospital visit can run tens of thousands of dollars in medical bills. An individual without health insurance will be responsible for the cost of that medical bill out of pocket. It’s hard to support a family if you are in debt. If you are unemployed or your company does not offer health insurance. There are various companies out there that cover individuals. Maximize Your Employer Benefits.