Comparison of Trading Platforms

Comparison of Trading Platforms – When a trader decides to work in the foreign exchange market, he needs to decide on the choice of a reliable trading platform, since this is the main tool for achieving success. The best decision would be to make a choice based on your needs and preferences, not just positive feedback. To do this, the trader must make a list of the characteristics and capabilities offered by the trading software developers, and then figure out which of them have the highest priority for him.

A trading platform or terminal is a program that makes it possible to be present and participate in the international foreign exchange market. Comparison of Trading Platforms. Comparison of Trading Platforms.

Major platform differences

All existing terminals have their own specific advantages. However, there are some general parameters according to which a trader can form an estimate.

Speed and performance

Some programs are not capable of providing high connection speeds. This negatively affects the price charts and the timeliness of trades. This indicator is key, since even a minute of delay can bring losses.

Functionality

Includes:

- number of analytical tools;

- number of timeframes;

- the number of open windows with quotes;

- the ability to add your own indicator and automatic trading;

- the ability to install on a PC or use the web version;

- robots and advisors;

- services for fundamental analysis;

- economic calendar;

- coverage of financial markets;

- the number of available financial instruments (futures, options, currency pairs, and so on).

Leverage risks

In forex, due to the presence of leverage, it does not require a large amount of initial investment in order to gain access to significant trades in foreign currency. Small price fluctuations can lead to negative margins when the investor needs to spend some of the money in the account. During volatile market conditions, aggressive leveraging results in significant losses in excess of the initial investment.

Convenience of the interface

The intuitive interface and the ability to customize it significantly affect the work process.

Safety

Security and privacy is ensured on all trading platforms, but this factor also depends on the broker.

Mobility

This is the ability to install the terminal on a mobile device, as well as its compatibility with various operating systems.

Do not assume that the better the functionality, the more convenient it will be to work with the platform. The platform must be adapted to specific conditions. For example, the MetaTrader (MT4or MT5) program has a range of modifications optimized for specific strategies.

Review of popular trading platforms

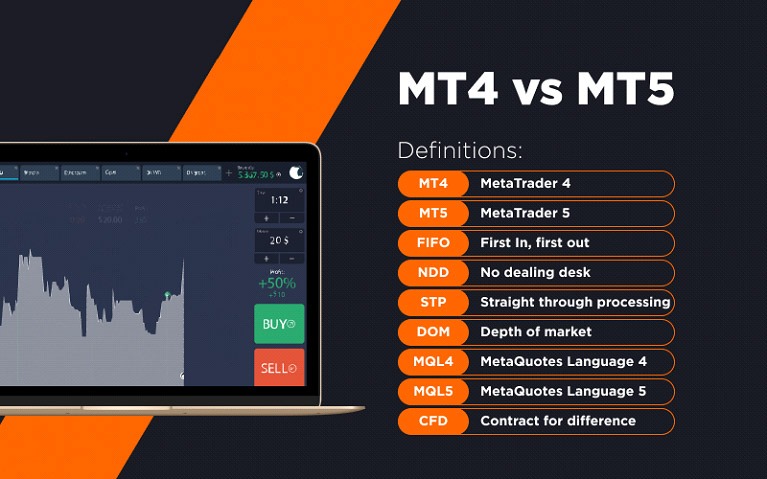

MetaTrader 4 and 5

MetaQuotes Software Corp developed MT4 in 2005. The program has a rich functionality, including the ability to create unique strategies for automated trading.

MT5 is a modified version of its predecessor. The platform’s functionality includes 79 analytical tools, 21 timeframes with an interval from one minute to a month, and much more.

MT4 & 5 are recognized as some of the best terminals due to their security, portability, extensive functionality and flexibility.

Mirror Trader

It allows you to see and analyze the actions of other professional traders, and then use the same techniques if necessary. There is a possibility of manual, semi-automatic and automatic mirror trading.

Ninja trader

NT is recognized as the standard in the foreign exchange market. The platform allows you to trade currency pairs, stocks, forwards, futures and options. It has a set of analytical resources for trading simulation and strategy creation. NT is safe, reliable, and easy to use. There is a paid and free platform option.

Zulu Trade

This platform is free and is a community of 1200 traders who collaborate and help each other track signals for more successful trading. You can register and become one of the signal providers, but this requires a good broker.

Successful trading directly depends on the terminal. The program should be simple and easy to use. With experience, it may be necessary to switch to another platform, which is why it is recommended to follow the news in the field of trading software.

Top 5 Forex risks

Investopedia highlights the Top 5 Forex risks that traders should definitely consider:

Leverage risks

In forex, due to the presence of leverage, it does not require a large amount of initial investment in order to gain access to significant trades in foreign currency. Small price fluctuations can lead to negative margins when the investor needs to spend some of the money in the account. During volatile market conditions, aggressive leveraging results in significant losses in excess of the initial investment.

Interest rate risks

We know from the basic macroeconomic rates that interest rates affect the exchange rates of currencies of different countries. If interest rates in a country rise, its currency is strengthened by the inflow of investments in the assets of that country, because a stronger currency provides a higher return. Conversely, if interest rates fall, the country’s currency will weaken as investors begin to withdraw their investments. Due to the nature of the interest rate and its effect on exchange rates, the difference between the value of currencies can lead to dramatic changes in forex prices.

Risks per transaction

Transaction risks are foreign exchange risks associated with the time difference between the commencement of the contract and the moment when it is paid. Forex is open 24 hours a day, which can lead to changes in exchange rates at any time. The greater the time difference between the conclusion of the contract and its payment, the higher the risk of the transaction. Any temporary differences allow foreign exchange risk to emerge, and individuals and corporations that trade in currencies face increased, and possibly onerous, transaction costs.

Counterparty risk

The counterparty in a financial transaction is the company that provides the asset to the investor. Thus, counterparty risk refers to the risk of default with the dealer or broker in a given transaction. In spot currency trading, counterparty risk comes from the solvency of the market maker. During volatile market conditions, the counterparty may be unable to fulfill or refuse to adhere to the contract. Transaction risks are foreign exchange risks associated with the time difference between the commencement of the contract and the moment when it is paid.

Finance Solutions, Insurance News, Finance News, Joker123, Slot Game, Game Slot, Sbobet88, Agen Sbobet, Slot Online.