Insure a Muscle Car

Insure a Muscle Car – Whether you currently own a classic muscle car or you’d like to. Regardless or the year make, or model involved we all have one very common need insurance. Ah, insurance – the one word that almost everyone (except insurance agents) say with a tone of disgust. Most of the time, people take on auto insurance policies and pay the premiums. Never actually have to make a major claim against the policy. However, should a situation ever happen where you would need to make a claim (in the event of theft, fire, a wreck, etc.). You’ll be thankful your insurance policy is there to help you. The purpose of insurance is to offset risk and with the skyrocketing values of muscle cars these days insuring them well is a must. This leads to the big question which type of insurance do you need? Here’s a 50,000 foot overview! Slot Game Online.

Regular Old Insurance? No way!

We’ll start by addressing the type of insurance that you don’t need: regular old car insurance. “Regular” car insurance is the type of insurance that you have on your daily driver. Which for most people is no older than a 15 year old car or truck. Should an event ever occur where your car is totaled out. The insurance company will send you a check for (basically) the blue book value of the car. I’m simplifying things a bit here but you get the point. The blue book values of cars decline with age. So obviously if you’ve just put $40,000 into restoring your ’67 GTX (or just purchased one) you’d need a different type of insurance. Slot Game Online.

Agreed Value

This is a type of policy where you and the insurance company agree on an amount of coverage value for your car (say $40,000), and you pay a monthly premium on that. Companies like Hagerty and Grundy have been issuing these policies for years – and they have very low premiums to match. It’s a great way to get your car covered for a high dollar amount at a low price. What’s the catch? Usage. They have absolutely no requirements on limiting annual mileage, but it’s essentially insurance for people that drive their cars in parades, to car shows, and the occasional cruise. Slot Game Online.

Stated Value

What if you’d like to use your car more frequently, or as a daily driver? In that case, “stated value” insurance is the way to go. This is essentially just like regular car insurance (so you’re covered in every situation). But with a value stated on the policy for the car’s value and coverage amount. You’d need to find an insurance company to work with. The major auto insurance companies (Allstate as an example) offer these style of policies (along with many others). It will NOT be as cheap as the agreed value policies. But it will provide you the coverage that you’re looking for. Slot Game Online.

Summary

When insuring your muscle car, determine how it is you wish to use the car first, and then choose the appropriate type of insurance based on that. If you’re a “parade, car show, and cruise” kind of guy. Agreed Value is the way to go especially if you have a high dollar car. If you’re looking to use the car as daily transportation, go with Stated Value. As with anything else though – price the policy both ways! Slot Game Online.

Property Insured Against

Home Insurance Plan protects you against loss/damage cause by:

1) Fire, Explosion (including explosion of domestic appliances like geyser, stoves) lightning, thunder bolt, earthquake.

2) Burglary, house breaking or any attempt of threat.

3) Riot strike, labour disturbance and malicious act.

4) Aircraft and other Aerial devices or articles dropped therefrom as well as falling trees.

5) Bursting or overflowing of underground water or sewerage pipes (excluding damage caused thereto)

6) Flood, Typhoon but excluding rain damage except when occurring during or immediately after typhoon.

7) Impact by Road Vehicle.

8) Personal accident cover.

9) Loss of Rent &

10) Terrorism.

The contents sum insured you choose should represent the full cost of replacing your contents as New with items of similar quality at today’s prices. Slot Game Online.

About My Valuables

Your valuables like jewelry are held covered when they are:

1) at residence or

2) in a specified locker or

3) in transit between residence and the locker and vice versa or

4) worn and robbed any-where in country Insured value of the jewelry.

5) Cash on body also covered during transit also covered.

Happens Under Insured

If your sum insured is insufficient any claim you make would be reduced in the same proportion as the amount of under-Insurance. Insure a Muscle Car. Slot Game Online.

Today’s Home or Property Insurance are both really important due to all of the hazards that can happen. It will provide you best the compensation of your valuable property.

Read More about Insurance News.

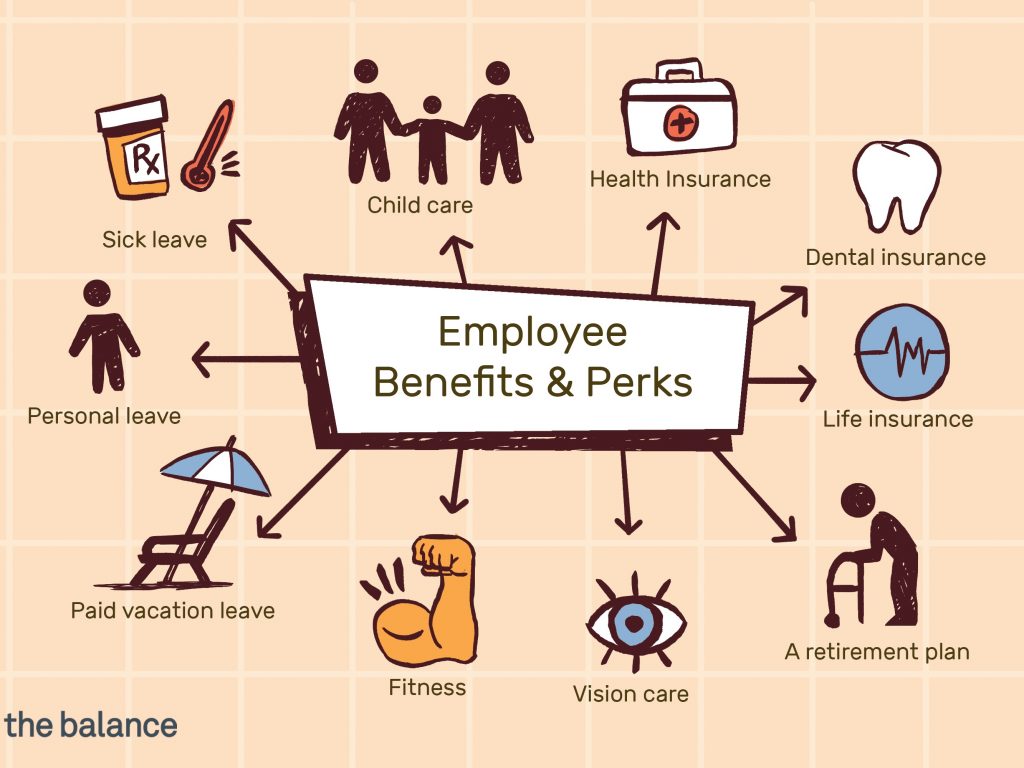

Maximize Your Employer Benefits

Maximize Your Employer Benefits